Вопросы-Ответы

We’ve been living in the UAE since 2010 and we know how to avoid mistakes and unwanted expenses because of bad recommendations.

We help successful and established people to buy the best property in Dubai. We work with all the developers directly and are able to offer you developer prices. We do not take any commission fees as our services are paid by the developers. Do not hesitate to contact us. Our real estate agency prides itself on employing the professional standards associated with a successful boutique business.

We offer only those units that we would like to buy ourselves. We act as a single point of information. If you contact a developer directly, you won’t get to know the entire story about the company’s other projects and any unfulfilled obligations. You won’t discover that in the same area you can find a more pleasing price for 1 sq.m. offered by another developer. All developers sell only their own projects without providing an objective overview of all the available properties.

If for a long time you have been wanting to make Dubai your second home or a new investment destination, then please contact us. We will ask you about every detail of the ideal unit that you want to buy, we will prepare a list of the best vari-ants, develop a roadmap of the entire process with figures and stages, carefully prepare all the documents and quickly register you as a property owner (even without your presence). We will provide recommendations on how to establish your ownership rights to make it possible to receive the title deeds and to hand your property down to your nearest and dearest without any difficulties.

We are not interested in lobbying on behalf of one developer. We honestly and openly tell you about all the advantages and disadvantages of each district and de-velopment project and provide you with the right to make a final decision.

If you already own real estate in Dubai or in other Emirates, we will be happy to help you to manage it. We will create a constant source of passive income and will oversee the depositing of funds into your accounts each month, quarter or year with detailed and clear reports for each period.

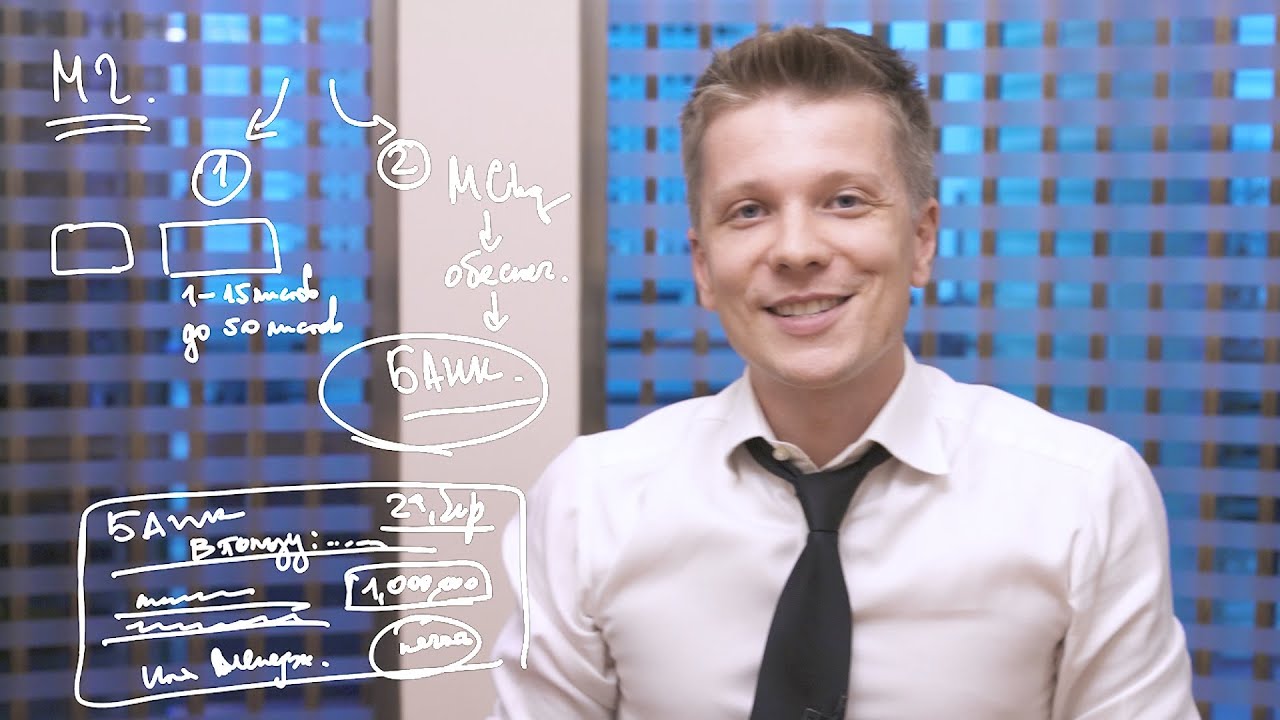

You can cash a check at the issuing bank of the check without having an Emirates residency, provided that the check does not contain two lines that mean credited only to a personal bank account. The fact of having a resident visa does not affect the possibility of obtaining funds for renting real estate. The main thing at the same time is to have a passport with you, proving your identity, since the spelling of your name on the check and in the passport will be checked and must match exactly. It is now possible for a non-resident to open a bank account, but this has become more difficult compared to 2013-2016. If the check is issued in the name of a company, and not to an individual, then funds will be credited only to the bank account of this company and only to the Emirati bank account.

! Please note that a check is valid for 6 months from the date printed on the check, if you cash it during this time it will be void.

!! If you need support with opening an account in Dubai, UAE, please contact UAE-Consulting.com. If earlier an account could be opened without problems in one day, then after 2017 the rules of banks in the UAE have changed and are still changing. Therefore, we recommend contacting professionals.

!!! If you prefer to receive passive income from rental property without wasting time on operating system, you can use the service of a real estate agency to manage and rent out your apartment in the UAE. In this case, the check can be issued in the name of the legal entity (real estate agency company) that is engaged in leasing, and then the real estate agency transfers or transfers it in cash to the Landlord. The most important thing at the same time is to choose a company that is comfortable for you, which you trust and with which you are comfortable interacting and working.

A check is, in fact, a payment guarantee, which is considered a financial obligation to pay the amount indicated on the check to the name of the person named on the check. Those. it's the same money, only with a deferred payment. The date when the check can be cashed at the bank is indicated on the check itself. Therefore, checks with future dates cannot be cashed before the specified date but can be cashed later than the specified date, if this occurs no later than 6 months from the date of the check issued.

To cash a check, the landlord must present it to the bank. Issuing checks that are empty of money at the time of cashing out (unsecured checks) is considered a criminal offense in the UAE. At the same time, at the time of issuing checks, you may not have the full amount in the account, but at the same time, you must do everything possible to ensure that these funds are available at the time of cashing out. This measure is a way to protect landlords and a convenient deferred payment tool for tenants.

Often, a clause is written in the contracts about what happens if the check is unsecured or not accepted by the bank (usually the amount of the fine is indicated). A check may not be accepted if the signature on the check does not match the signature of the account holder, for example, or if the check itself is incorrectly filled out. Be sure to check the spelling of the name on the check, it must exactly match the spelling of the name in the passport, otherwise, the check will be rejected.

Regardless of the emirate, real estate rent is paid for the entire period in advance (most often it is half a year / a year in advance). In this case, mutual settlements occur through bank checks. Depending on the agreement, payment can be made by one check for the entire period (for example, for a year) or several checks for the entire period (for example, one check per month).

Step 1. The Landlord finds a tenant.

Step 2. A lease agreement is concluded between the two parties, specifying: (a) the amount of the annual lease; (b) the procedure for mutual settlements; (c) the term of the lease; (e) conditions for renewal of the contract; (f) the procedure for covering the costs of maintenance and operation of real estate; (g) liability of the parties in case of failure to comply with the terms of the contract

Step 3. When signing the contract, the Tenant pays the total rent (using post-dated checks) and a security deposit (usually 5% of the annual rent).

Step 4. After payment, the Tenant gets the keys and access cards to the property and common areas. Copies of documents are necessary to activate utilities (electricity, water, air conditioning, telephone, Internet), including the Landlord’s passport, Title Deed copy, Emirates ID of the Landlord, a copy of the Landlord’s residence visa, as well as other agreed documents if it’s necessary.

Since 2012, all lease agreements under the law of the Emirate of Dubai must be officially registered in the Ejari / Ejari system (from Arabic Ejari - “my lease”) under the Real Estate Regulatory Authority (RERA). Although the service has its own application, registration must be done in person. As confirmation of registration, a special Ejari certificate (Ejari certificate) with a unique barcode is issued. Both the landlord and the tenant can register the lease agreement, but according to the law, this must be done by the owner of the apartment.

The current fine is 50,000 dirhams.

At the same time, in case of non-compliance with the provision on mandatory registration, the participants in the transaction do not have the right to apply to state bodies to protect their rights and interests or resolve disputes, for example, to a body specially created for this - the Rental Committee.

In Abu Dhabi, for example, the system for registering lease agreements is called Tawtheeq, while in the northern emirates it is done simply in the municipality.

A real estate lease agreement in Dubai, UAE can only be concluded with an individual or legal entity that (a) has the status of a resident in the Emirates; or (b) with an individual who is a citizen of the UAE; or (c) with a citizen of a country that is a member of the Cooperation Council for the Arab States of the Gulf (GCC).

An individual is recognized as a resident if he has a resident visa of the United Arab Emirates and an identity card of the United Arab Emirates (Emirates ID).

A legal entity is recognized as a resident if it is registered in the territory of the United Arab Emirates, regardless of the emirate and the form of registration: it can be an offshore, free economic zone (free zone) or a local company.

There are no restrictions for setting a rental price in the UAE. The main requirement, though, is the registration of the rental agreement in the Real Estate Regulatory Authority (RERA) system, which is called Ejari (from Arabic «my rent»). As a confirmation of successful agreement registration, an Ejari certificate is issued.

Landlords are entitled to raise rent given they’ve provided 90 days’ notice before the expiry of the lease. (v) a maximum of 20 percent increase is permissible if the current rent is less than anything greater than 40 percent of the average market rental rate.

Compared to residential real estate, the commercial real estate market is less attractive. At the same time, commercial real estate can generate a higher income (up to 15%), but this is highly dependent on many factors: the type of property, its location, and the cost of maintenance.

Depending on the type of property, its location, and the maintenance cost, the average ROI in the UAE is 3-4% for villas, 5-7% for long-term rentals, and 8-12% for short-term rentals.

According to Law No. 26 of 2007, «On the regulation of relations between landlord and tenant» and Law No. 33 of 2008 amending Law No. 26, any owner of real estate in the territory of the Emirate of Dubai has the full right to rent out his property. The common practice in the Emirates is a lease for a year in advance with a subsequent extension.

Any owner also has the right to give the apartment to the management of a real estate agency, which will save time interacting with tenants and solving related problems.

Step 1. A potential Buyer finds a property they like.

Step 2. The Buyer and Seller sign a SPA («Sale and Purchase agreement») containing the following information:

1. Purchase price in numbers and writing;

2. A list of all additional fees (specifying real estate agency fees/developer’s fees/deposit amounts, etc.) ;

3. The date of transfer and the penalty payment scenario;

4. Mutual settlements between the parties procedure;

5. Obligations of the parties in case of non-fulfillment of the contract;

Step 3. During the signing of the sale and purchase agreement, the Buyer, as proof of serious intention, deposits the amount of 10% (ten percent) of the total value of the acquired property.

Step 4. The Seller receives special permission from the developer — NOC (No Objection Certificate) to sell the property. This document is necessary for the next step.

Step 5. Seller and Buyer meet in the Land Department or the Dubai Land Department Trustee Office. The Buyer pays money to the Seller, and the transaction is recorded in the blockchain registry of the Land Department. Upon completion, the Certificate of Ownership (Title Deed) is reissued, a document establishing and confirming the real estate ownership.

The service charge includes expenses related to cleaning and maintenance of common areas (corridors, flights of stairs, garbage chute, adjacent territory, garbage collection); cleaning and maintenance of common areas (elevators, swimming pool, gym, parking, recreation rooms), building security costs and other expenses as needed.

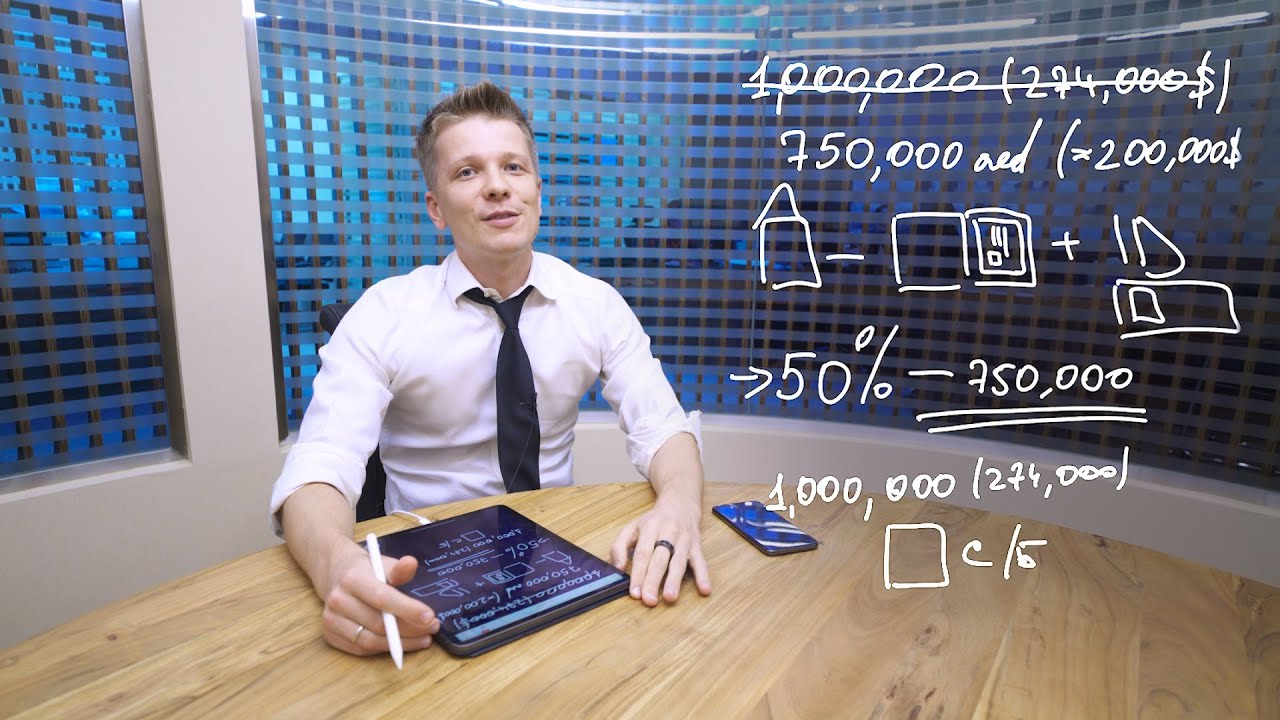

The fee is paid either once a year or twice a year (depending on the project). The cost of maintenance is on average from 25 to 85 US dollars per square meter.

The property owner is responsible for the timely payment of fees to maintain the house and common areas in proper condition. Such a fee is paid by all owners and is called “Service fee” or Service Charges. They are essentially the same thing, just a difference in terminology. The amount of the fee is determined by the relevant Maintenance Company, also referred to as the Service Company. If the house has an Association of Owners, then it is she who appoints the service company and sets the amount of fees.

In the UAE, there a no tax on the purchase, ownership, and management (renting out) of real estate within the jurisdiction of the United Arab Emirates. Also, there are no automatic taxes imposed on the death of an individual in the UAE. There is also no inheritance tax or gift tax. However, the recipient of a donation of immovable property located in the UAE must pay a transfer fee when the property transfer is registered.

Fee 1. 4% (four percent) of the value of the property. This is the required fee that is required to be paid to the Land Department in order to process the transfer of ownership of real estate in the UAE from one person to another.

Fee 2. 4,000 AED (four thousand dirhams), which is equivalent to approximately 1,100 US dollars, is required to be paid to the Authorized Office of the Land Department (Dubai Land Department Trustee Office).

Fee 3. ~400 AED (four hundred dirhams), which is equivalent to approximately 110 US dollars, is required to be paid to the Land Department for issuing an updated Certificate of Title.

Land Department is a government-run entity in the UAE that manages all real estate operations in a specific emirate. Since the UAE is a federal state, each emirate has its land department; for example, in Dubai, it is the Dubai Land Department, in Abu Dhabi, it is the Abu Dhabi Land Department, etc. Since May 2018, all Dubai title deeds have been registered in the blockchain. All owners get a Certificate of Ownership (Title Deed). It is a document confirming real estate ownership rights.

For off-plan projects, Dubai Land Department issues a pre-title deed certificate called Oqood. It is valid until construction of the property has been completed, and you get a Title Deed.

To register Oqood, the Buyer has to pay at least 25% of the unit price to the developer before registering Oqood with RERA.

Lease agreements in Dubai are registered in the Real Estate Regulatory Authority (RERA) system, which is called Ijari / Ejari (from Arabic Ejari — «my lease»). As confirmation, the Tenant is issued an Ejari certificate.

Regardless of citizenship, any foreign citizen has the right to purchase, own, and dispose of real estate at personal discretion in specially designated areas — freehold areas. The complete list of freehold areas is set by the Regulation of the Ruler of Dubai No. 3 of 2006 (you can download it in the Laws of the UAE section). The most popular Dubai areas are Beachfront, Dubai Marina, The Palm Jumeirah, Jumeirah Lakes Towers, Dubai Downtown, etc.

الأشياء الحصرية ، وتحليلات السوق ، والمواد المفيدة حول اختيار العقارات ، وأسرار الاستثمار المربح وأكثر من ذلك بكثير موجودة بالفعل في الاشتراك